NEWS

The prices have gone up again! Shipping companies are adding peak season surcharges on nearly 60 routes...

2024/07/04

At present, the situation in the Red Sea remains increasingly chaotic. Recently, the Houthi armed forces have escalated their attacks and improved their accuracy, increasing the frequency of their strikes. If the situation continues to deteriorate, further exacerbating the pressure on the global shipping supply chain, the risk spillover may continue to push up freight rates.

Multiple ships attacked again

The latest news reports that on the 28th, the Houthi armed forces claimed to have carried out a series of attacks on multiple vessels in the Mediterranean and Red Sea areas. This includes a fierce attack on one ship and an attack on a Maersk vessel.

The Houthi spokesman, Yahya, insisted that all Houthi attack operations are targeted at ships that support Israel or dock at Israeli ports. He specifically mentioned that Maersk is one of the "companies most supportive of Israel" in their view.

The UK Maritime Trade Office did indeed receive a report from an unnamed vessel. According to the captain's description, they were located 150 nautical miles northwest of Hodeidah, Yemen, when five missiles fell near the ship. Fortunately, there was no damage or casualties, and the ship is still sailing normally.

Subsequently, the Houthi forces further claimed in their latest statement that they had attacked two ships in the Red Sea.

One of them was the Delonix, a product oil tanker registered in Liberia and managed by the Greek Merman Maritime company, which was sailing from the Suez Canal to China. The other was the bulk carrier Ioannes, which the Houthi forces claimed was attacked by "multiple unmanned surface vessels."

Additionally, two ships in the Mediterranean region were also attacked. One was the container ship "JOHANNES MAERSK," registered in Denmark with a capacity of 3000 TEU.

The other was the Turkish-owned and managed product oil tanker Waler (7279 deadweight tons), registered in Panama, which was originally planned to sail from Turkey to Suez, but the Houthi forces claimed it was "heading to the Haifa port."

Sareya stated that the Houthi forces will continue to carry out joint military operations, covering the Red Sea, the Arabian Sea, and the Indian Ocean, until the aggressive actions against Yemen and Palestine cease, and the blockade against the Palestinian people is lifted; otherwise, the military actions will not be halted.

Following the outbreak of a new round of Israeli-Palestinian conflict in October last year, the Yemeni Houthi forces have repeatedly targeted locations in the Red Sea with drones and missiles. Since January 12th of this year, the United States and the United Kingdom have launched multiple airstrikes on Houthi targets, resulting in casualties.

In early May, the Yemeni Houthi forces announced that they would expand their scope of operations, targeting all vessels of companies that have had transactions with Israel in the past few months, in the Red Sea, the Arabian Sea, the Indian Ocean, and the Mediterranean Sea, regardless of the nationality of these ships or the destination ports.

Imposing Nearly 60 Peak Season Surcharges (PSS)

Affected by the crisis, the container shipping market is facing unprecedented additional risks and cost challenges, hence shipping companies are currently imposing or planning to temporarily impose more high surcharges.

On June 27th, Maersk published a comprehensive list of peak season surcharges (PSS) on its official website.

The report extensively covers the surcharge collection for different origin and destination ports in the Asia-Pacific region, Europe, India, the Middle East and Africa, as well as Latin America.

These charges vary depending on the validity period and container type. Below are nearly 60 peak season surcharge (PSS) collection standards involving the Asia-Pacific map, including China, Hong Kong, Macao, and Taiwan, to ports around the world.

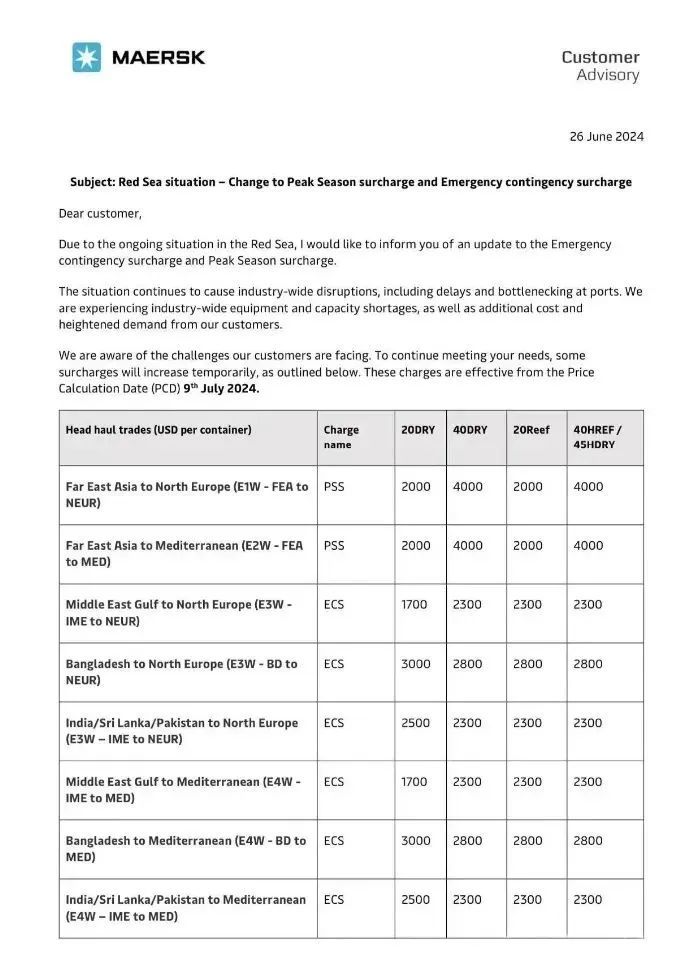

It is worth noting that in the announcement on June 26th, Maersk specifically pointed out that due to the ongoing tensions in the Red Sea region, the company will increase the emergency contingency surcharge and peak season surcharge.

The announcement mentioned: "The current situation continues to disrupt the entire industry, including port delays and bottlenecks. Faced with industry-wide shortages of container equipment and space, as well as additional costs and high demand driven by increased customer demand. Maersk is well aware of the challenges faced by customers, but in order to continue to meet customer needs, it has to temporarily increase certain surcharges."

Specifically, from July 9th, the peak season surcharge (PSS) from East Asia to Northern Europe will be increased to $2,000 for small containers and $4,000 for large containers.

Since May and June, shipping prices have seen round after round of increases, with major shipping companies repeatedly raising prices, driving up the prices of main routes such as Asia-Europe, the US line, and South America. The lack of supply capacity caused by various reasons such as diversions, port congestion, and strikes has also given shipping companies the impetus to continue raising their quotes.

The recent situation in the Red Sea is difficult to resolve, and freight rates are variable. Shippers and freight forwarders who need to ship goods should closely monitor relevant information, communicate in advance, and plan their shipments well to avoid affecting delivery.